Are you paying more in taxes than you need to? Choosing the right business structure—Sole Proprietor, S Corporation (S Corp), Partnership, or C Corporation (C Corp)—could save you thousands of dollars each year. But how do you know which one is right for you?

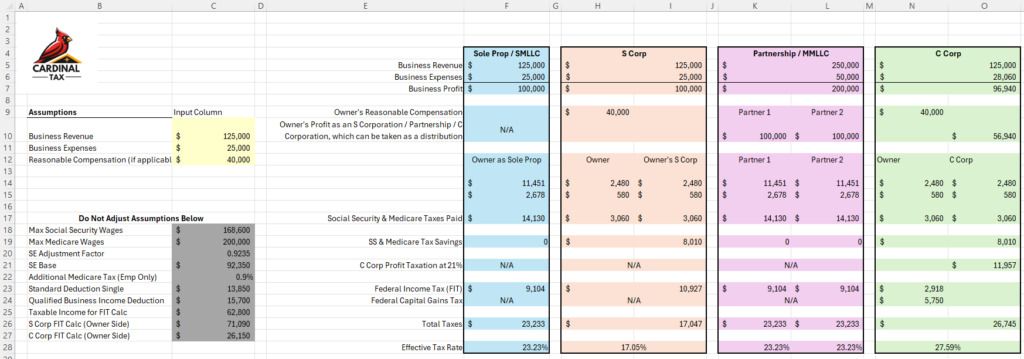

I’ve developed an easy-to-use spreadsheet to compare the tax obligations for each structure, showing you exactly where you can save money. Spoiler alert: S Corps could be your golden ticket to reducing self-employment taxes.

Why This Spreadsheet is a Game-Changer

Taxes can be overwhelming, but this tool simplifies the process. Here’s what it shows you:

- Side-by-Side Comparisons: See how Sole Proprietors, S Corps, Partnerships, and C Corps stack up.

- Self-Employment Tax Savings: Learn why S Corps help you avoid paying 15.3% self-employment tax on a portion of your profits.

- Real Numbers: Based on $125,000 in revenue, $25,000 in expenses, and a reasonable salary of $40,000, you’ll see exactly how the tax savings add up. But here’s the great part: you can input the numbers from your business. Use the yellow input cells to do this and the spreadsheet will update based on that.

For example, as a Sole Proprietor, you’d pay self-employment tax on the full $100,000 profit—$15,300. But as an S Corp, by allocating $40,000 as salary and the rest as distributions, you avoid $9,180 in self-employment taxes. That’s real money you can reinvest in your business or put back into your pocket.

Why You Need This Spreadsheet

Most small business owners unknowingly leave money on the table. The right business structure isn’t just about compliance; it’s about strategy. My spreadsheet takes the guesswork out of the equation, helping you:

- See Immediate Tax Savings: Understand how a simple shift to an S Corp can drastically reduce your tax burden.

- Make Informed Decisions: Choose the structure that aligns with your goals and maximizes your profitability.

- Take Control of Your Finances: Empower yourself with clear, actionable data.

Who Is This For?

This spreadsheet is perfect for:

- Sole Proprietors wondering if it’s time to take the next step.

- LLC Owners considering an S Corp election.

- Business Partners evaluating tax obligations under different structures.

- Entrepreneurs looking for ways to minimize taxes legally and effectively.

Don’t Miss Out—Get Your Spreadsheet Now!

Don’t let another tax year slip by without optimizing your structure. Download my Tax Comparison Spreadsheet today and see for yourself how much you could save.

It’s simple, fast, and could save you thousands.

Take the first step toward smarter tax planning. Your business—and your wallet—will thank you.